Featured

What Percentage Do Merchants Pay For Visa

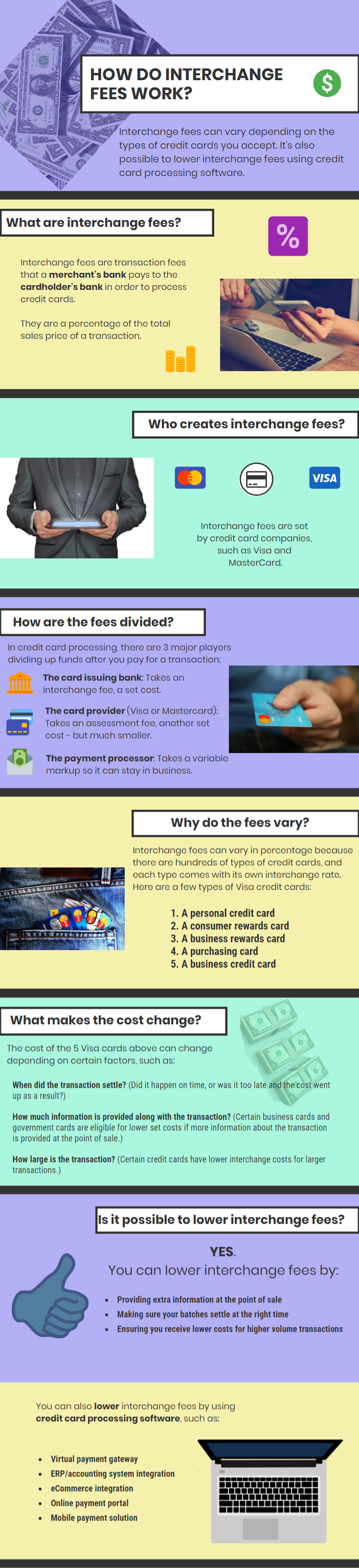

Every time you use your credit card to make a purchase the merchant pays what is called the merchant discount fee The merchant discount fee is. The companies are also planning to hike fees that banks pay to process card payments on behalf of merchants.

Average Credit Card Processing Fees In 2020 Bankrate

Average Credit Card Processing Fees In 2020 Bankrate

Merchants generally pay a 1 to 3 fee for the processing of payments for each transaction.

What percentage do merchants pay for visa. Very roughly low-risk businesses that take cards in person can expect rates starting around 2. The processors markup percentage is typically anywhere between 020 and 075 and your transaction fees can be anything from 015 to 030. It depends upon the type of merchant risk type of the payment.

Merchants do not pay interchange reimbursement feesmerchants negotiate and pay a merchant discount to their financial institution that is typically calculated as a percentage per transaction. Mastercard charges 01375 for credit transactions of 1000 or lower and 01475 for those of 1000 or higher. So what do businesses pay for credit card transactions.

Merchants can receive a variety of processing services from financial institutions that may be included in their merchant discount rate. And roughly 35 percent for all keyed-in transactions. Processors buy their rates from Visa MC or process directly for them.

Industry average transaction size monthly volume and how the merchant accepts cards all play in role in how much theyll pay. As it relates to accepting Visa products merchants must accept Visa products for legal transactions only. Visa is committed to delivering safe secure and reliable payment solutions that meet the needs of merchants and their customers.

This is the most important percentage you need to know since every processors rates and fees work differently. Merchants that sell age-restricted products such as alcohol and tobacco must have in place processes and controls to ensure that all associated laws are honoured. Using a credit card responsibly can improve your finances.

I infact have been told someone was charged 58 but as I have no proof so cant comment on the same. You can figure Visa MC gets 1 to 14 of the transaction. Credit card companies charge between approximately 13 and 35 of each credit card transaction in processing fees.

Contactless payments or tapping to pay with a contactless card or mobile device are fast becoming the preferred way to pay globally with nearly 60 percent of Visa transactions outside of the US. The average credit card processing cost for a retail business where cards are swiped is roughly 195 2 for Visa Mastercard and Discover transactions. Discover also charges 013 as an assessment fee on its credit cards.

Visa charges a 014 assessment fee for every charge made with its credit cards and a 013 fee for transactions made with its debit cards. Mastercard 155 percent to 26 percent. Visa 143 percent to 24 percent.

In an interchange plus pricing model your payment processor adds a fixed markup on top of the interchange. Do use it if your car breaks down and you dont have another mode of transport. It ranges from 199 to 45.

Speaking generally a good effective rate for credit card processing is around 3-4 though again the particulars of your business may mean that your ideal effective rate is different. Merchants do not pay interchange reimbursement feesmerchants negotiate and pay a merchant discount to their financial institution that is typically calculated as a percentage per transaction. These rates on average to the merchant are 155 25 cent transaction fee to 180 25 cent transaction fee.

All merchants accepting Visa have a responsibility to adhere to the law. Alternatively the merchant discount rate is also referred to. A 2 0103 markup a 18 interchange fee 390 fee on a.

Credit card surcharges grow more common. Occurring with a tap. So a 100 transaction would cost you 240.

If you pay for something with cash and a debit card and are not satisfied with the service or the goods are damaged then it is up to the merchant whether you will receive a refund. They generally range between 15 percent and 29 percent of the purchase price when the c ustomer swipes versus inserts the card. The exact amount depends.

Federal law caps debit card swipe fees at 21 cents per transaction. If youre looking for quick numbers here you go. Swipe fees for credit card transactions vary by purchase amount but they average 2 percent of the total.

Discover and AmEx are not included -. Visa uses these fees to balance and grow the payment system for the benefit of all participants. Right now Visa Rewards Signature cards cost merchants 23 010 of a transaction.

There isnt just one rate fee nor is Visa the only player that imposes a fee. Its worth noting that some cards and transactions come with higher interchange rates so your processing rate will still vary slightly but not as much as youll see with tiered pricing. The four major networks have the following average costs.

What Are The Average Credit Card Processing Fees That Merchants Pay 2021 Update Payment Depot

What Are The Average Credit Card Processing Fees That Merchants Pay 2021 Update Payment Depot

What Are The Average Credit Card Processing Fees That Merchants Pay 2021 Update Payment Depot

What Are The Average Credit Card Processing Fees That Merchants Pay 2021 Update Payment Depot

What Are The Average Credit Card Processing Fees That Merchants Pay 2021 Update Payment Depot

What Are The Average Credit Card Processing Fees That Merchants Pay 2021 Update Payment Depot

What Are The Average Credit Card Processing Fees That Merchants Pay 2021 Update Payment Depot

What Are The Average Credit Card Processing Fees That Merchants Pay 2021 Update Payment Depot

What Are The Average Credit Card Processing Fees That Merchants Pay 2021 Update Payment Depot

What Are The Average Credit Card Processing Fees That Merchants Pay 2021 Update Payment Depot

/https://www.thestar.com/content/dam/thestar/business/personal_finance/2013/07/23/how_credit_card_fees_for_merchants_work/credit_cards.jpg) How Credit Card Fees For Merchants Work The Star

How Credit Card Fees For Merchants Work The Star

Credit Card Processing Fees And Rates Cardfellow

Credit Card Processing Fees And Rates Cardfellow

What Are The Average Credit Card Processing Fees That Merchants Pay 2021 Update Payment Depot

What Are The Average Credit Card Processing Fees That Merchants Pay 2021 Update Payment Depot

How Much Are Credit Card Fees For Merchants

How Much Are Credit Card Fees For Merchants

What Are The Average Credit Card Processing Fees That Merchants Pay 2021 Update Payment Depot

What Are The Average Credit Card Processing Fees That Merchants Pay 2021 Update Payment Depot

What Are The Average Credit Card Processing Fees That Merchants Pay 2021 Update Payment Depot

What Are The Average Credit Card Processing Fees That Merchants Pay 2021 Update Payment Depot

What Are The Average Credit Card Processing Fees That Merchants Pay 2021 Update Payment Depot

What Are The Average Credit Card Processing Fees That Merchants Pay 2021 Update Payment Depot

What Are The Average Credit Card Processing Fees That Merchants Pay 2021 Update Payment Depot

What Are The Average Credit Card Processing Fees That Merchants Pay 2021 Update Payment Depot

Comments

Post a Comment