Featured

How Do You Lose Money On Options

FAVR did move higher and 90 days after your option purchase the market price was 46. A Put option locks in the selling price of a stock.

:max_bytes(150000):strip_icc()/TheDangerousLureofCheapoutoftheMoneyOptions3_3-597f84b5320646f8a6afcc66446c188a.png) The Dangerous Lure Of Cheap Out Of The Money Options

The Dangerous Lure Of Cheap Out Of The Money Options

Traders lose money because they try to hold the option too close to expiry.

How do you lose money on options. If you sell a naked put it means that you sell the put without owning the stock. All you have to do is stare at your charts all day long until a winning trade magically appears. The only problem is that you correctly predicted the price increase and still lost money.

Normally you will find that the loss of time value becomes very rapid when the date of expiry is approaching. The only way to lose a lot of money in options is through selling calls. While it is not impossible to be profitable on any trade despite this.

Its just eye blood. Purchasing a straddle on these stocks each expiration would have netted you a loss of almost 123. Another options strategy that can potentially lose you money in the stock market is selling naked puts.

If the stock did not move lower than the strike price of the put option contract by expiration the option trader would lose their entire premium paid 044. ATM options therefore pay a higher. So if you buy an option with a strike price of 70 this will allow you to sell the stock for 70 anytime between the day you buy the option and when it expires.

We need enough trades to allow the process to work and to allow my Edge to. Learn to make money here first. 1Traders lose money because options are a depreciating asset.

Quite often traders lose money on long options as they hold the option ahead of key events. Who cares if your eyes start bleeding. The put option gives you the right to sell the same stock at the same set strike price before expiration.

How Can You Lose Money Trading Options. Stick with stocks for a long while. Likewise if the stock moved up regardless of how much it moved upward then the.

If playback doesnt begin shortly try restarting your device. It is bad enough to lose when your prediction is wrong but losing money when it is correct is a bad result. Since options lose money with the passage of time the purchasers of options are at a mathematical disadvantage.

You want get a higher price for a stock that you wish to sell. Hence if you are getting a good price it is better to exit at a profit when there is still time value left in the option. To buy the two options youll need to pay one premium for the call option and another.

They lose money with each passing day that the security underlying their option stands still. Whoever blinks first loses. HOW TO TRADE BINARY OPTIONS NEVER LOSE MONEY in binary options trading This is the best interactive broker option trading 2021 video trading with Best IQ.

While theoretically you could lose an unlimited amount in actuality losses are usually curtailed. The brokerage institutes a stop order which essentially purchases the. Depending on the options strategy employed an individual stands to profit.

If the price of the stock stays above the strike price you are golden. On call options buying the call you can lose your entire investment thats 100. But if you want long-term staying power you have to focus on the process and the long-term plan.

This means that options lose value with the passage of time. Videos you watch may be added to the TVs watch history and influence TV recommendations. So make sure you concentrate and stare long and hard at your charts.

Trading is really just a staring contest between you and the market. When you purchase an option your upside can be unlimited and the most you can lose is the cost of the options premium. Yet it happens all the time in the options world.

You should choose a strike price that is close to the stocks price so that the call is likely to expire in-the-money thus calling away or selling your stock. You buy the call the stock dips and the option you bought can go to zero and fast. If the stock jumps quickly and someone exercises their option you can be forced to sell the.

Options are a mathematical probability game that is not won on any 1 trade. In addition at-the-money ATM options have more time valuethan do options with strikes that are further away from the stocks current price. Now you could make a lot of money on any one trade.

However if the price of the stock drops below the strike price youll be forced to buy the stock at the strike price. This Options Game that I designed is a probability game best played over a longer period of time. By contrast buying straddles on the expensive options would have generated a.

So if the stock falls to 60 your Put option will go up in value.

The Dangerous Lure Of Cheap Out Of The Money Options

What Is Options Trading How To Trade Options Ig Uk

What Is Options Trading How To Trade Options Ig Uk

Buying Call Options The Benefits Downsides Of This Bullish Trading Strategy Commodity Com

Buying Call Options The Benefits Downsides Of This Bullish Trading Strategy Commodity Com

Why Option Buyers Lose Money Angel Broking

Why Option Buyers Lose Money Angel Broking

Why 90 People Lose Money In Options Ever Traded Options Must Watch Youtube

Why 90 People Lose Money In Options Ever Traded Options Must Watch Youtube

/BeginnersGuidetoCallBuying2-c1fe9d54ba0e4afd819e61159f100d29.png) Beginner S Guide To Call Buying

Beginner S Guide To Call Buying

How Can You Lose Money Trading Options Youtube

How Can You Lose Money Trading Options Youtube

/TheImportanceofTimeValueinOptionsTrading1_3-ad26c7e621bb4a19ae4549e833aab296.png) The Importance Of Time Value In Options Trading

The Importance Of Time Value In Options Trading

How Options Can Lose Money Even When You Re Right Tradesmart University

How Options Can Lose Money Even When You Re Right Tradesmart University

:max_bytes(150000):strip_icc()/TheDangerousLureofCheapoutoftheMoneyOptions1-1e3d7a1ba4b5403f8fadef0cffa42d6c.png) The Dangerous Lure Of Cheap Out Of The Money Options

The Dangerous Lure Of Cheap Out Of The Money Options

:max_bytes(150000):strip_icc()/TheDangerousLureofCheapoutoftheMoneyOptions2_3-421b6fae9a9949bc8d11ac334e225fe8.png) The Dangerous Lure Of Cheap Out Of The Money Options

The Dangerous Lure Of Cheap Out Of The Money Options

/TheDangerousLureofCheapoutoftheMoneyOptions1-1e3d7a1ba4b5403f8fadef0cffa42d6c.png) The Dangerous Lure Of Cheap Out Of The Money Options

The Dangerous Lure Of Cheap Out Of The Money Options

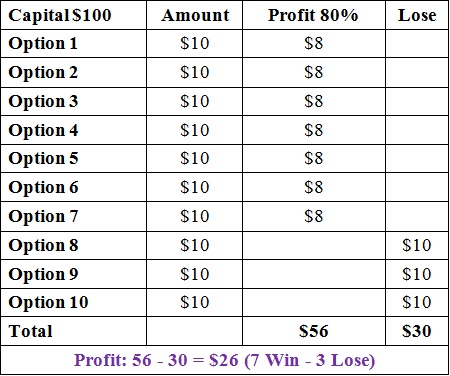

Top 5 Capital Management Strategies When Trading Options In Iq Option

Top 5 Capital Management Strategies When Trading Options In Iq Option

Trading Options 6 Sureshot Strategies To Lose Money Consistently By Mhachamo Kithan Medium

Comments

Post a Comment