Featured

Offshore Tax Havens

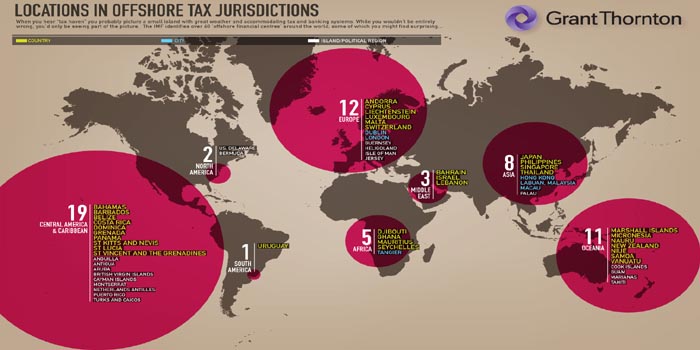

Also known as offshore financial centers. Tax havens guarantee confidentiality of t people or corporations with offshore bank accounts or offshore companies in offshore tax havens.

Amazon Fr Treasure Islands Uncovering The Damage Of Offshore Banking And Tax Havens Shaxson Nicholas Livres

Amazon Fr Treasure Islands Uncovering The Damage Of Offshore Banking And Tax Havens Shaxson Nicholas Livres

Because information can be hard to extract tax havens are sometimes also called.

Offshore tax havens. They have friendly tax laws which enable individuals andor companies to minimize or eliminate their tax liability They allow foreign citizens to register offshore companies which are given preferential tax treatment and are not. Offshore tax havens can be described as territories or countries with very low or no taxes. But there are also ways in which individuals can remain living in a non-tax haven such as the UK and still benefit from tax havens.

Tax havens are places where business people and other super-wealthy individuals keep money in offshore accounts for tax avoidance and other purposes. Tax havens are found in almost every corner of the world and so the list of tax havens is long. They offer a.

Offshore havens which are also called tax havens or offshore tax havens. Person is seeking to skirt the IRS and illegally evade US tax by shifting their tax residence to a foreign country but that is not always the case. According to modern studies the Top 10 tax havens include corporate-focused havens like the Netherlands Singapore Ireland and the UK while Luxembourg Hong Kong the Caribbean the Caymans Bermuda and the British Virgin Islands and Switzerland feature as both major traditional tax havens and major corporate tax havens.

The typical key features of offshore tax havens are. In addition to privacy its service rate is very affordable. The list of countries which offer tax havens includes Andorra the Bahamas Belize Bermuda the British Virgin Islands and the Cayman Islands.

Offshore Tax havens levy little or no taxes to foreign investors without setting foot in the country. Tax havens have low tax rates in some cases 0 and laws protecting the privacy of account holders. There is a common misconception that offshore tax haven means that a US.

There are only few handful tax havens in the world right now what we can call pure. An offshore tax haven is a geographical location where corporate bodies and individuals have the option of avoiding taxes legally. Offshore tax havens benefit from the capital their countries draw into the economy.

Tax havens also typically limit public disclosure about companies and their owners. For example when a person wants to set up a. While offshore accounts are typically associated with very wealthy individuals and giant corporations an increasing number of everyday people are taking advantage of lower tax rates by placing their money in foreign financial institutions.

Offshore havens are known to provide international financial services such as offshore banking the incorporation of offshore companies the. Others are the Cook Islands Honk Kong the Isle of. Offshore tax havens are secrecy jurisdictions that exist expressly to enable their clients to escape the scrutiny of regulators and tax authorities in their own countries.

There is no universal definition but tax havens or offshore financial centers are generally countries or places with low or no corporate taxes that allow outsiders to easily set up businesses there. Choisissez parmi des contenus premium Offshore Tax Havens de la plus haute qualité. The tax havens have been described as countries or jurisdictions which have low tax rates and have protection laws in place which provides privacy and secrecy for offshore clients.

The concept of an offshore tax haven can mean different things to different people. Offshore tax havens have exacerbated income inequality increased global financial instability and allowed multinational corporations and their shareholders to pocket trillions of. Normally there is legislation established for protecting the privacy of corporations and nationals of other countries regardless the type of offshore service that the corporation.

Some of these havens offer financial secrecy by refusing to share information with international tax authorities. Tax havens is a list of offshore tax havens and the best tax haven offshore services that they offer. If an individual keeps their assets in a trust in an offshore.

Funds can flow in from individuals and businesses with accounts setup at banks financial institutions and other. Offshore Tax havens can be defined as countries with zero or low taxes. Trouvez les Offshore Tax Havens images et les photos dactualités parfaites sur Getty Images.

Tax Havens Complete Guide Of Setting Up An Offshore Corporate Structure

Tax Havens Complete Guide Of Setting Up An Offshore Corporate Structure

Top 75 Best High End Tax Haven Offshore International Financial Centers News Reviews Resources

Top 75 Best High End Tax Haven Offshore International Financial Centers News Reviews Resources

Will President Trump Put An End To Offshore Tax Havens Silver Law

Will President Trump Put An End To Offshore Tax Havens Silver Law

Top 12 Tax Havens Countries Around The World In 2021

Top 12 Tax Havens Countries Around The World In 2021

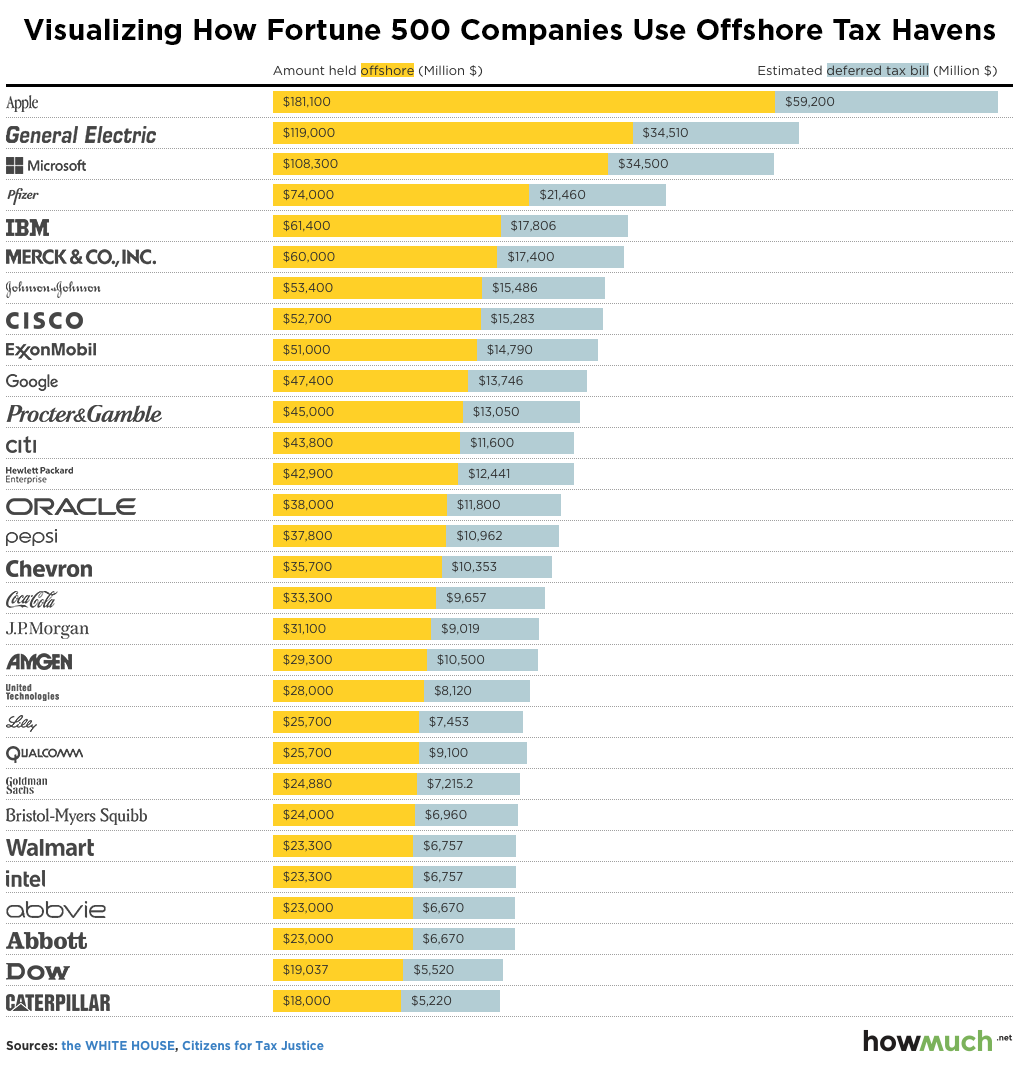

Tax Havens A Paradise For Us Tech Giants Berkeley Economic Review

Tax Havens A Paradise For Us Tech Giants Berkeley Economic Review

Chart U S Tech Companies Hoard Billions In Offshore Tax Havens Statista

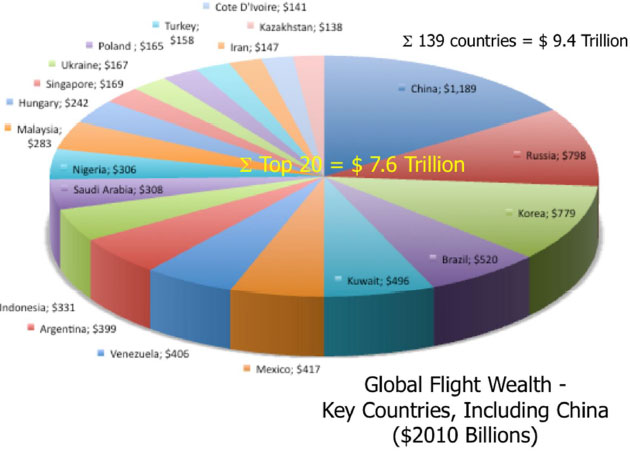

Study Super Rich Hiding 21 Trillion In Offshore Tax Havens Mother Jones

Study Super Rich Hiding 21 Trillion In Offshore Tax Havens Mother Jones

Elite Banking At Your Expense How Secretive Tax Havens Are Used To Steal Your Money

Elite Banking At Your Expense How Secretive Tax Havens Are Used To Steal Your Money

What Is A Tax Haven Offshore Finance Explained Icij

What Is A Tax Haven Offshore Finance Explained Icij

Visualizing How Fortune 500 Companies Use Offshore Tax Havens

Visualizing How Fortune 500 Companies Use Offshore Tax Havens

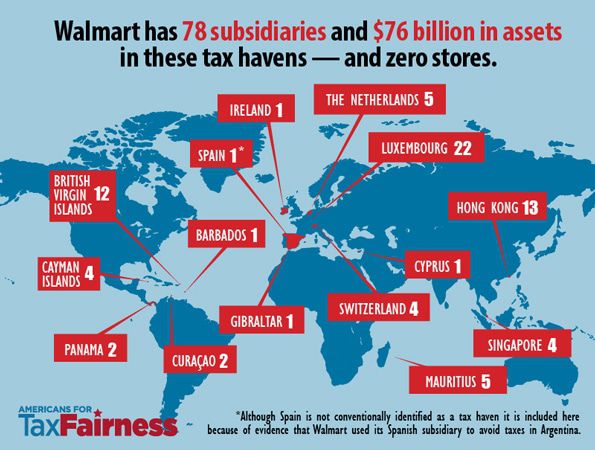

Tax Havens Americans For Tax Fairness

Tax Havens Americans For Tax Fairness

Tax Haven This Tax Avoidance That Is Offshore Finance Such A Big Deal The Conscious Community

Tax Haven This Tax Avoidance That Is Offshore Finance Such A Big Deal The Conscious Community

Which U S Companies Have The Most Tax Havens Infographic

Which U S Companies Have The Most Tax Havens Infographic

Comments

Post a Comment