Featured

How Much Does The Us Collect In Taxes

The majority of states received more in federal services than what they pay in federal taxes. How Much Money the Government Collects in Taxes the Totals For the 2018 fiscal year the government brought in 332 trillion in revenue.

What Are The Sources Of Revenue For The Federal Government Tax Policy Center

What Are The Sources Of Revenue For The Federal Government Tax Policy Center

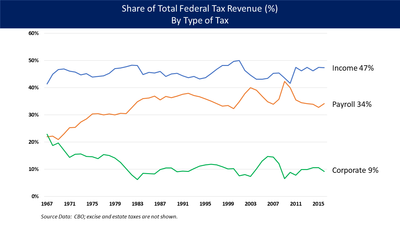

So overall income tax.

How much does the us collect in taxes. In 1980 it collected about 135 of GDP in taxes about half of the US yet by 2001 it had nearly doubled tax revenues almost catching up with the US. The percentage was about the same for 2019. 64 rows The federal government estimates it will collect 3863 trillion in taxes for FY 2021.

Heres How Much Your State Makes From Taxes. Income tax made up 55 of the 85. Individual income taxes are always the largest portion of earned income for the government.

In any case despite specific cases such as Turkey differences today remain large and there is. In another recent article my colleague Brian Feroldi determined that the average American pays a wage-based tax rate of nearly 32 between income. Internal Revenue Gross Collections.

Local governments rely heavily on property taxes to fund schools roads police departments and fire and emergency medical services as well as other services associated with residency or property ownership. Your Tax Dollars at Work The federal budget for the 2020 fiscal year that us Oct. These tables breakout the total taxes paid by type of tax including corporation individual employment estate gift and excise taxes.

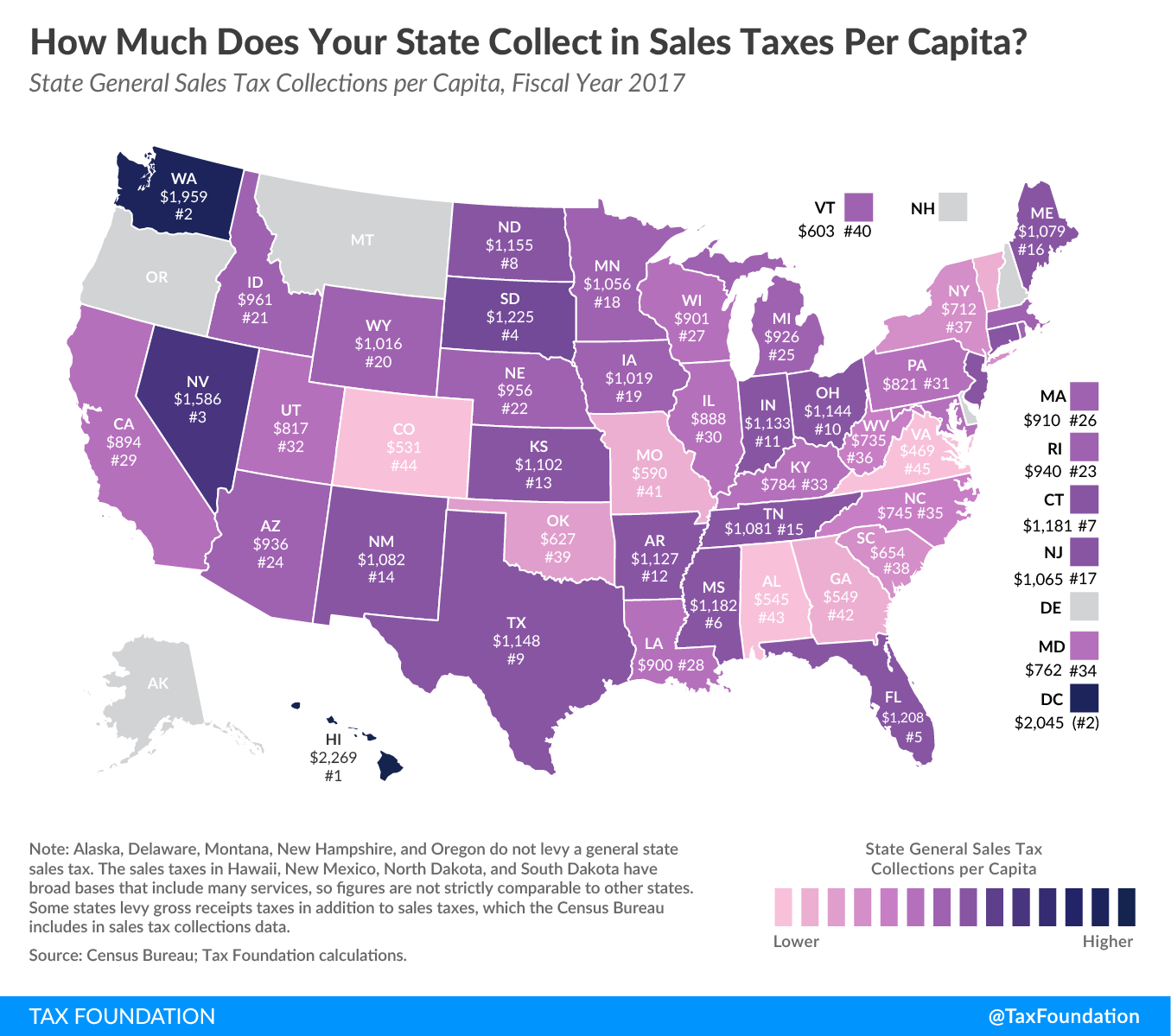

In fiscal year FY 2017 the most recent year of data available property taxes generated 319 percent of total US. Currently state gas taxes range from 1432 cents per gallon in Alaska to 6205 cents per gallon in California not including the 184 cents per gallon federal gas tax. Internal Revenue Gross Collections.

1 2019 to Sept. The federal government received 33 trillion in gross taxes from individuals businesses and estates up from nearly 306 trillion the previous year and the largest amount since 1960 according. As illustrated in the graph below in 2019 the richest 1 percent of Americans will collect more than 1 in 5 of income in the United States 209 percent and will pay a slightly higher share of the nations overall federal state and local taxes 241 percent.

General sales and gross receipts taxes. Shown by state and by type of tax including corporation individual and employment railroad retirement unemployment insurance estate. 30 2020 is about 46 trillion according to the Congressional Budget Office which requires.

Annual revenues by year since 1789. The top 1 percent of taxpayers paid roughly 616 billion or 385 percent of all income taxes while the bottom 90 percent paid about 479 billion or 299 percent of. State and local tax collections and 721 percent of local tax collections.

In 2017 the top 1 percent of taxpayers accounted for more income taxes paid than the bottom 90 percent combined. In 2020 individual and payroll tax revenue accounted for 85 of the governments revenue. They accounted for 51 approximately 17 trillion of the income for the year.

Rather than dedicating all gas tax revenue to roads and highways many states divert portions of the revenue to non-road and non-transportation purposes. State tax collections per capita in the United States fiscal year 2012 Net tax revenues from housing tax in Taiwan FY 2009-2019 Taxes on income and property in India FY 2013-2021. Individual income tax returns filed by an estimated 150 million-plus people in 2016 resulted in the collection of nearly 155 trillion.

The case of Turkey stands out. In Iowa each resident is receiving 797 more back in federal services than they paid in taxes.

What Are The Sources Of Revenue For The Federal Government Tax Policy Center

What Are The Sources Of Revenue For The Federal Government Tax Policy Center

Federal Tax Revenue By State Wikipedia

Federal Tax Revenue By State Wikipedia

What Are The Sources Of Revenue For The Federal Government Tax Policy Center

What Are The Sources Of Revenue For The Federal Government Tax Policy Center

What Are The Sources Of Revenue For The Federal Government Tax Policy Center

What Are The Sources Of Revenue For The Federal Government Tax Policy Center

Explainer The 4 Trillion U S Government Relies On Individual Taxpayers Reuters

Explainer The 4 Trillion U S Government Relies On Individual Taxpayers Reuters

How Much Does Your State Collect In Sales Taxes Per Capita

How Much Does Your State Collect In Sales Taxes Per Capita

Soi Tax Stats Irs Data Book Internal Revenue Service

Soi Tax Stats Irs Data Book Internal Revenue Service

United States Federal Budget Wikipedia

United States Federal Budget Wikipedia

Explainer The 4 Trillion U S Government Relies On Individual Taxpayers Reuters

Explainer The 4 Trillion U S Government Relies On Individual Taxpayers Reuters

Feds Collect Record Individual Income Taxes In Fy 2018 Still Run 779b Deficit Cnsnews

Feds Collect Record Individual Income Taxes In Fy 2018 Still Run 779b Deficit Cnsnews

Federal Revenue Where Does The Money Come From

Federal Revenue Where Does The Money Come From

Who Pays Taxes In America In 2019 Itep

Who Pays Taxes In America In 2019 Itep

What Are The Major Federal Excise Taxes And How Much Money Do They Raise Tax Policy Center

What Are The Major Federal Excise Taxes And How Much Money Do They Raise Tax Policy Center

Policy Basics Where Do Federal Tax Revenues Come From Center On Budget And Policy Priorities

Policy Basics Where Do Federal Tax Revenues Come From Center On Budget And Policy Priorities

Comments

Post a Comment